New Delhi: Union Finance Minister Arun Jaitley on Thursday proposed to establish 24 new medical colleges and hospitals, 18 new Schools of Planning & Architecure (SPAs) and Railways University at Vadodara in Gujarat in the Union Budget 2018-19.

“We have taken steps to set up a specialized Railways University at Vadodara”, the Finance Minister said, adding that 18 new Schools of Planning & Architecture (SPAs) will also be established in IITs and NITs as autonomous schools.

"In order to take care of the education and health care needs of Below Poverty Line (BPL) and rural families, the Budget proposes to increase the cess on Personal Income Tax and Corporation Tax to 4 percent from the present 3 percent.

"The new cess will be called the “Health and Education Cess” and is expected to lead to a collection of an estimated additional amount of Rs. 11,000 crore", Jaitley said.

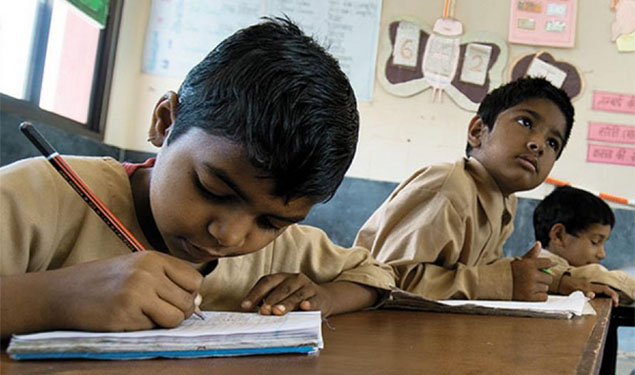

Jaitley also announced setting up of Ekalavya Model Residential School on par with Navodaya Vidyalayas to provide the best quality education to the tribal children in their own environment by 2022 in every block with more than 50% ST population and at least 20,000 tribal persons with special facilities for preserving local art and culture besides providing training in sports and skill development.

Expressing concern over the quality of education, Arun Jaitley said that education will be treated in a holistic manner from pre-nursery to Class XII. He also said that a district-wise strategy for improving the quality of education is also being prepared.

"It is also proposed to abolish the Education Cess and Secondary and Higher Education Cess on imported goods. In its place it is proposed to impose a Social Welfare Surcharge at the rate of 10 percent of the aggregate duties of Customs, on imported goods, to provide for social welfare schemes of the government.

"However, goods which were so far exempt from Education Cesses on imported goods, will however continue to be so. In addition, certain specified goods, mentioned in Annexure 6 of the Budget speech, will attract the proposed Surcharge, at the rate of 3 percent of the aggregate duties of customs only", Jaitley said.

Jaitley presented in the Parliament his fifth consecutive budget on Thursday – the last before the 2019 Lok Sabha polls.

Interestingly, Prime Minister Modi had on various occasions in the past has claimed that his government did not draft policies keeping in mind elections and vote bank.

However the general budget which Finance Minister Arun Jaitley presented in the Parliament was clearly poll oriented and focused more on rural areas – aimed at cooling down the anger of the farmers against present dispensation.

“MSP for all unannounced kharif crops will be one and half times of their production cost like majority of rabi crops: Institutional Farm Credit raised to 11 lakh crore in 2018-19 from 8.5 lakh crore in 2014-15”, Jaitley said in his about two hour long budget speech.

“22,000 rural haats to be developed and upgraded into Gramin Agricultural Markets to protect the interests of 86% small and marginal farmers.

“Operation Greens” launched to address price fluctuations in potato, tomato and onion for benefit of farmers and consumers”, he added.

Budget Highlights

- Two New Funds of Rs10,000 crore announced for Fisheries and Animal Husbandary

sectors; Re-structured National Bamboo Mission gets Rs.1290 crore. - Loans to Women Self Help Groups will increase to Rs.75,000 crore in 2019 from 42,500

crore last year. - Higher targets for Ujjwala, Saubhagya and Swachh Mission to cater to lower and middle class in providing free LPG connections, electricity and toilets.

- Outlay on health, education and social protection will be 1.38 lakh crore. Tribal students to get Ekalavya Residential School in each tribal block by 2022. Welfare fund for SCs gets a boost.

- World‟s largest Health Protection Scheme covering over 10 crore poor and vulnerable families launched with a family limit upto 5 lakh rupees for secondary and tertiary treatment.

- Fiscal Deficit pegged at 3.5 %, projected at 3.3 % for 2018-19.

- Rs. 5.97 lakh crore allocation for infrastructure

- Ten prominent sites to be developed as Iconic tourist destinations

- NITI Aayog to initiate a national programme on Artificial Intelligence (AI)

- Centres of excellence to be set up on robotics, AI, Internet of things etc

- Disinvestment crossed target of Rs 72,500 crore to reach Rs 1,00,000 crore.

- Comprehensive Gold Policy on the anvil to develop yellow metal as an asset class

- 100 percent deduction proposed to companies registered as Farmer Producer Companies with an annual turnover upto Rs. 100 crore on profit derived from such activities, for five years from 2018-19.

- Deduction of 30 percent on emoluments paid to new employees Under Section 80-JJAA to be relaxed to 150 days for footwear and leather industry, to create more employment.

- No adjustment in respect of transactions in immovable property where Circle Rate value does not exceed 5 percent of consideration.

- Proposal to extend reduced rate of 25 percent currently available for companies with turnover of less than 50 crore (in Financial Year 2015-16), to companies reporting turnover up to Rs. 250 crore in Financial Year 2016-17, to benefit micro, small and medium enterprises.

- Standard Deduction of Rs. 40,000 in place of present exemption for transport allowance and reimbursement of miscellaneous medical expenses. 2.5 crore salaried employees and pensioners to benefit.

For all the latest Business News, download ummid.com App

Select Langauge To Read in Urdu, Hindi, Marathi or Arabic

| Quick links

| Quick links