New Delhi: In a bid to reduce the huge numbers of fake numbers of Permanent Account Numbers (PAN), the central government deactivated 11 lakhs PANs which violated the rules, the concerned ministry said Monday.

Minister of State for Finance Santosh Kumar Gangwar told Rajya Sabha that 11 lakh PANs have been identified and deleted or deactivated till July 27.

According to government's rules and regulations, no person is entitled to hold more than one PAN. A penalty of Rs 10,000 is liable to be imposed under section 272B of the Income-tax Act, 1961 if the rule is violated.

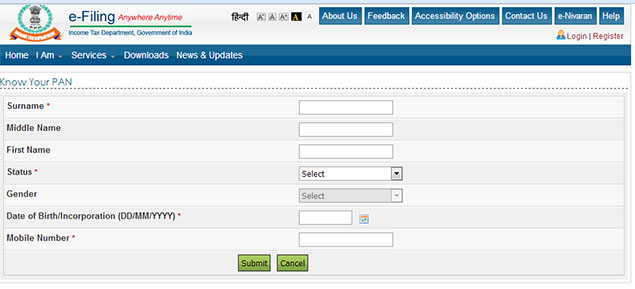

Follow the link given as under to check if your PAN is one of those deactivated by the government.

- Click here to go the Department of Income Tax website: incometaxindiaefiling.gov.in

- The screen like the one shown above should appear on your monitor/cell phone

- Enter your Name, Gender, Date of Birth along with Mobile Number.

- Enter the OTP received on the given Mobile phone

- Result page will show PAN and jurisdiction officer address and active/inactive status

Permanent Account Number (PAN) is a code which acts as an identification for Indian nationals, especially those who pay Income Tax. It is a unique number, 10-character alpha-numeric identifier, issued to all judicial entities identifiable under the Indian Income Tax Act, 1961.

Sometimes a PAN is also issued to foreign nationals, such as investors, subject to a valid visa, and hence, it is not acceptable as a proof of Indian citizenship.

| Quick links

| Quick links